Vote NO on Prop 22 to protect labor rights and classify app-based drivers as employees, not contractors.

Proposition 22 asks voters to exempt companies like Lyft, Postmates, Uber, DoorDash, and others from a recently implemented state worker protection law, Assembly Bill 5 (AB5), so they can classify gig economy drivers from ride-share and delivery companies as independent contractors, not as employees. Additionally, Prop 22 would restrict local regulation of app-based drivers and would criminalize the impersonation of drivers.

Why voting NO on Prop 22 matters

-

By classifying workers as contractors and not employees, companies like Lyft, Uber, and DoorDash are exempted by state employment laws from ensuring basic protections to their workforce including minimum wage, overtime, unemployment insurance, and workers’ compensation.

-

Currently, rideshare and delivery workers are entitled under AB 5 to labor rights that every other employee in California receives, such as the right to organize, health insurance, and Social Security benefits. Prop 22 would take those rights away.

-

AB 5 also guarantees paid family leave, paid sick days, and unemployment insurance to those classified as gig employees. Proposition 22 asks voters to make gig-economy employees exempt from this law and replaces their rights with fewer benefits of much less value to their workers.

-

More than 2,000 drivers have filed claims against Uber and Lyft for over $630 million in damages, expenses, and lost wages. Prop 22 will codify Uber and Lyft’s abilities to systematically steal wages from drivers.

-

Uber and Lyft currently owe California $413 million in unemployment insurance contributions due to misclassifying drivers as independent contractors under AB 5. If Prop 22 passes, Uber and Lyft would get away with not paying what they owe.

Misinformation About Prop 22

- "The cost of ride-share will go up, decreasing the amount of people who will pay for rides and services and forcing companies to lay off more workers." -- FALSE. The nonpartisan Legislative Analyst’s Office found that because these companies would not have to pay for standard employee benefits and protections (roughly 20 percent of total employee costs), companies can charge lower delivery fees and fares. It is projected that this will increase companies’ profits and drivers’ state income taxes.

-

"Prop 22 will guarantee 120% of minimum wage to all drivers." -- FALSE. The UC Berkeley Labor Center released a report that estimates Prop 22’s “pay guarantee” for their Uber and Lyft drivers would only end up being $5.64 per hour after accounting for all the expenses that drivers are responsible for themselves. At that rate, even if an individual worked 10 hour days, 7 days a week under Prop 22, they would be living below the California poverty line.

-

"Prop 22 will give health insurance to all drivers." -- FALSE. Under Prop 22, companies do not pay for health insurance, but instead provide a stipend to drivers. This stipend is valued at only 82% of the minimum coverage provided by state law, and is actually worth even less because workers would owe state and federal income taxes on the stipend. Prop 22 forces drivers to work more than 39 hours a week to qualify for the health stipend, so many workers would never even qualify for the stipend. For drivers who do qualify, Health Access California estimates that the health stipend would be just a couple hundred dollars—and could be just tens of dollars for younger workers—not enough for drivers to cover the purchase of their own health insurance.

What Is At Stake

If Prop 22 is passed, all future labor legislation surrounding Uber and Lyft would have to be approved by 7/8 of the total California State Legislature. Making this happen is virtually impossible considering Uber and Lyft have donated $2 million to the California Republican Party campaign committee. This is why Uber and Lyft are spending millions of dollars: to make their operations virtually untouchable in terms of regulation.

Top Funders of Prop 22

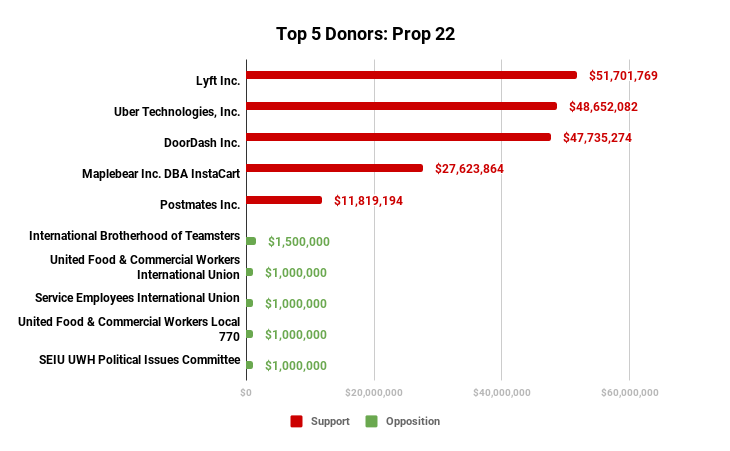

- Lyft, Uber, and DoorDash are leading contributions in support of Prop 22, with over $148 million between the three of them. Both InstaCart and Postmates have contributed $27 and $11 million each respectively, for a grand total of over $187 million in support of Prop 22. Their coalition to pass Prop 22 is now the most expensive California ballot measure since 1992.

- International Brotherhood of Teamsters, United Food & Commercial Workers International Union, Service Employees International Union, United Food & Commercial Workers Local 770, and SEIU-UWH Political Issues Committee have contributed a total of $5.5 million in opposition to Prop 22.

Progressive Landscape

Vote NO on Prop 22 to protect labor rights and classify app-based drivers as employees, not contractors.

Proposition 22 asks voters to exempt companies like Lyft, Postmates, Uber, DoorDash, and others from a recently implemented state worker protection law, Assembly Bill 5 (AB5), so they can classify gig economy drivers from ride-share and delivery companies as independent contractors, not as employees. Additionally, Prop 22 would restrict local regulation of app-based drivers and would criminalize the impersonation of drivers.

Why voting NO on Prop 22 matters

-

By classifying workers as contractors and not employees, companies like Lyft, Uber, and DoorDash are exempted by state employment laws from ensuring basic protections to their workforce including minimum wage, overtime, unemployment insurance, and workers’ compensation.

-

Currently, rideshare and delivery workers are entitled under AB 5 to labor rights that every other employee in California receives, such as the right to organize, health insurance, and Social Security benefits. Prop 22 would take those rights away.

-

AB 5 also guarantees paid family leave, paid sick days, and unemployment insurance to those classified as gig employees. Proposition 22 asks voters to make gig-economy employees exempt from this law and replaces their rights with fewer benefits of much less value to their workers.

-

More than 2,000 drivers have filed claims against Uber and Lyft for over $630 million in damages, expenses, and lost wages. Prop 22 will codify Uber and Lyft’s abilities to systematically steal wages from drivers.

-

Uber and Lyft currently owe California $413 million in unemployment insurance contributions due to misclassifying drivers as independent contractors under AB 5. If Prop 22 passes, Uber and Lyft would get away with not paying what they owe.

Misinformation About Prop 22

- "The cost of ride-share will go up, decreasing the amount of people who will pay for rides and services and forcing companies to lay off more workers." -- FALSE. The nonpartisan Legislative Analyst’s Office found that because these companies would not have to pay for standard employee benefits and protections (roughly 20 percent of total employee costs), companies can charge lower delivery fees and fares. It is projected that this will increase companies’ profits and drivers’ state income taxes.

-

"Prop 22 will guarantee 120% of minimum wage to all drivers." -- FALSE. The UC Berkeley Labor Center released a report that estimates Prop 22’s “pay guarantee” for their Uber and Lyft drivers would only end up being $5.64 per hour after accounting for all the expenses that drivers are responsible for themselves. At that rate, even if an individual worked 10 hour days, 7 days a week under Prop 22, they would be living below the California poverty line.

-

"Prop 22 will give health insurance to all drivers." -- FALSE. Under Prop 22, companies do not pay for health insurance, but instead provide a stipend to drivers. This stipend is valued at only 82% of the minimum coverage provided by state law, and is actually worth even less because workers would owe state and federal income taxes on the stipend. Prop 22 forces drivers to work more than 39 hours a week to qualify for the health stipend, so many workers would never even qualify for the stipend. For drivers who do qualify, Health Access California estimates that the health stipend would be just a couple hundred dollars—and could be just tens of dollars for younger workers—not enough for drivers to cover the purchase of their own health insurance.

What Is At Stake

If Prop 22 is passed, all future labor legislation surrounding Uber and Lyft would have to be approved by 7/8 of the total California State Legislature. Making this happen is virtually impossible considering Uber and Lyft have donated $2 million to the California Republican Party campaign committee. This is why Uber and Lyft are spending millions of dollars: to make their operations virtually untouchable in terms of regulation.

Top Funders of Prop 22

- Lyft, Uber, and DoorDash are leading contributions in support of Prop 22, with over $148 million between the three of them. Both InstaCart and Postmates have contributed $27 and $11 million each respectively, for a grand total of over $187 million in support of Prop 22. Their coalition to pass Prop 22 is now the most expensive California ballot measure since 1992.

- International Brotherhood of Teamsters, United Food & Commercial Workers International Union, Service Employees International Union, United Food & Commercial Workers Local 770, and SEIU-UWH Political Issues Committee have contributed a total of $5.5 million in opposition to Prop 22.

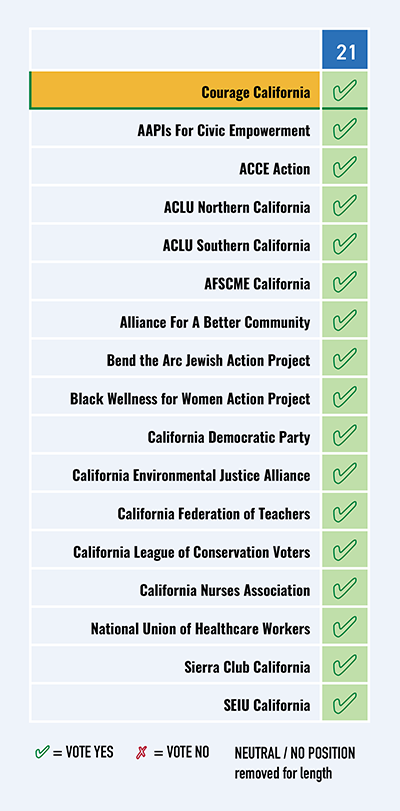

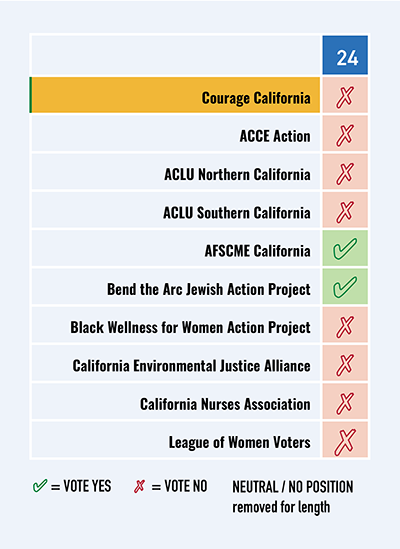

Progressive Landscape